What is the 50 20 30 budget rule?

Índice

- What is the 50 20 30 budget rule?

- How should I budget my money?

- What is the 50 30 20 budget rule and how does it work?

- What is the best monthly budget app?

- What is the 70 20 10 Rule money?

- What is a good budget for a house?

- What is the $5 Challenge?

- What is the 70/30 rule?

- What is the easiest budget app?

- How should a beginner budget?

- How to become better at budgeting your money?

- How to budget your money the easy way?

- How can budgeting help manage your money?

- How do you budget money wisely?

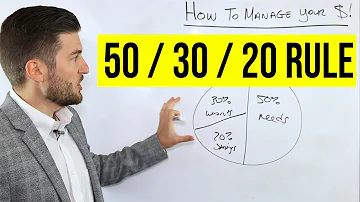

What is the 50 20 30 budget rule?

What is the 50-20-30 rule? The 50-20-30 rule is a money management technique that divides your paycheck into three categories: 50% for the essentials, 20% for savings and 30% for everything else. 50% for essentials: Rent and other housing costs, groceries, gas, etc.

How should I budget my money?

How to budget money

- Calculate your monthly income, pick a budgeting method and monitor your progress.

- Try the rule as a simple budgeting framework.

- Allow up to 50% of your income for needs.

- Leave 30% of your income for wants.

- Commit 20% of your income to savings and debt repayment.

What is the 50 30 20 budget rule and how does it work?

Senator Elizabeth Warren popularized the so-called " budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

What is the best monthly budget app?

Best budgeting apps

- Best overall free app: Mint.

- Best app for serious budgeters: You Need a Budget (YNAB)

- Best app for over-spenders: PocketGuard.

- Best app for investors: Personal Capital.

- Best app for couples: Honeydue.

What is the 70 20 10 Rule money?

Both 70-20-10 and 50-30-20 are elementary percentage breakdowns for spending, saving, and sharing money. Using the 70-20-10 rule, every month a person would spend only 70% of the money they earn, save 20%, and then they would donate 10%.

What is a good budget for a house?

One of the easiest ways to calculate your homebuying budget is the 28% rule, which dictates that your mortgage shouldn't be more than 28% of your gross income each month. The Federal Housing Administration (FHA) is a bit more generous, allowing consumers to spend as much as 31% of their gross income on a mortgage.

What is the $5 Challenge?

A $5 challenge is sweeping through social media and fans say it's the easiest way to save thousands. The savings hack involves putting aside every $5 note you receive into a secret stash for use at the end of 2021. “The challenge is every time you receive a $5 note put it away, if you break a note and get $5 bills ...

What is the 70/30 rule?

The 70% / 30% rule in finance helps many to spend, save and invest in the long run. The rule is simple - take your monthly take-home income and divide it by 70% for expenses, 20% savings, debt, and 10% charity or investment, retirement.

What is the easiest budget app?

Using a budget app can turn your iPhone or Android into a personal money management machine....Here are some of the best apps available; let's take a closer look at what they have to offer.

- Mint. ...

- PocketGuard. ...

- You Need a Budget (YNAB) ...

- Wally. ...

- Goodbudget. ...

- Simple. ...

- BUDGT. ...

- Mvelopes.

How should a beginner budget?

How To Create A Budget

- Step 1: Calculate your monthly income. ...

- Step 2: Add up your fixed monthly expenses. ...

- Step 3: Set financial goals. ...

- Step 4: Determine your discretionary expenses. ...

- Step 5: Subtract your income from expenses. ...

- Step 6: Implement, monitor, and adjust your budget.

How to become better at budgeting your money?

- Calculate Expenses. ...

- Turn Yearly Expenses Into Monthly Expenses. ...

- Determine Post Taxes Income. ...

- Build a Safety Net of Money. ...

- Become More Frugal With Other Expenses. ...

- Set Short and Long Term Goals to Focus On. ...

- Check Out Saving and Checking Account Every Month. ...

- Use Helpful Budgeting Tools. ...

- Determine How Frugal You Want to Live. ...

How to budget your money the easy way?

- 7 Steps to a Budget Made Easy Set Realistic Goals. Goals for your money will help you make smart spending choices. ... Identify your Income and Expenses. You probably know how much you earn each month - but do you also know where it all goes? ... Separate Needs and Wants. Ask yourself: Do I want this or do I need it? ... Design Your Budget. ... Put Your Plan into Action. ... Seasonal Expenses. ... Look Ahead. ...

How can budgeting help manage your money?

- Helps you organize your spending and savings - By dividing your money into categories of expenditures and savings, a budget makes you aware which category of expenditure takes which portion of your money. That way, it is easy for you to make adjustments.

How do you budget money wisely?

- Method 1 of 3: Budgeting Your Money Make a list of your guaranteed monthly income. Calculate all of your income on a monthly basis. ... Track all of your expenses each month. Keep all of your receipts to get an accurate picture of your spending habits. Break your expenses down into fixed, essential, and non-essential. ... Keep these records every single month. ...